-

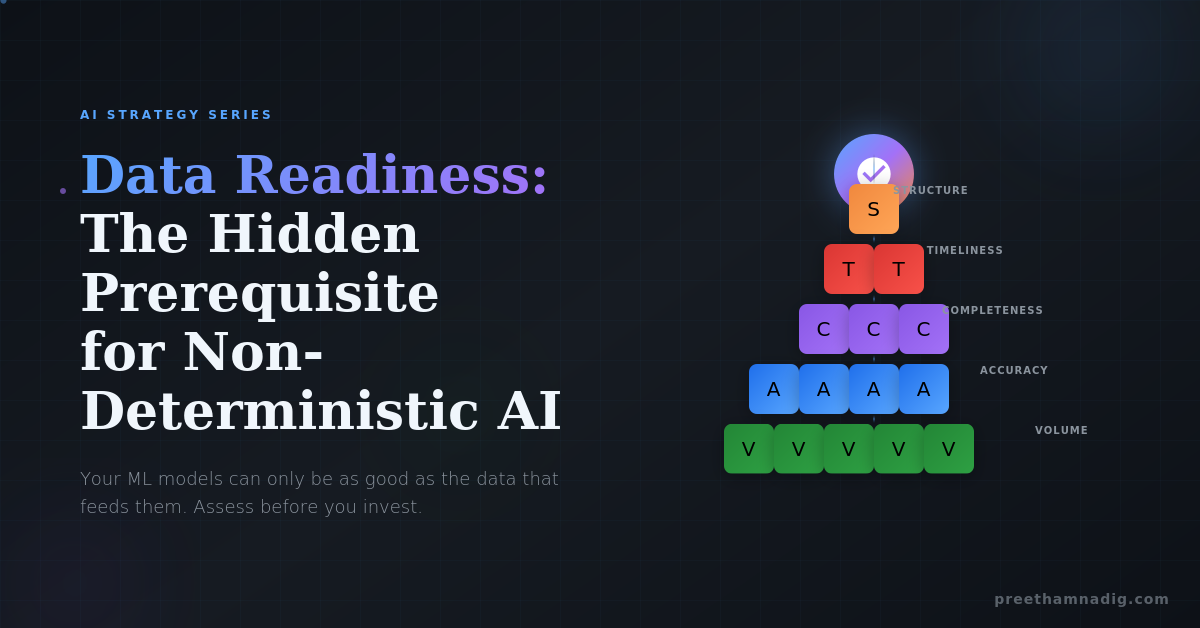

Data Readiness: The Hidden Prerequisite for Non-Deterministic AI

Your machine learning models can only be as good as the data that feeds them. Before investing in sophisticated algorithms, invest in understanding what your data can—and can’t—support. In my previous posts on the AI project landscape and guardrails for autonomous systems, I highlighted a critical consideration that deserves its… Read ⇢

-

The Prompt Paradox: 8 Frameworks to Turn AI Confusion into AI Confidence

Your organization just rolled out AI tools. Now comes the hard part: getting everyone to actually use them well. The Great Prompt Divide Here’s a scene playing out in enterprises everywhere: A knowledge worker stares at an AI chat interface, cursor blinking, unsure what to type. They’ve attended the training.… Read ⇢

-

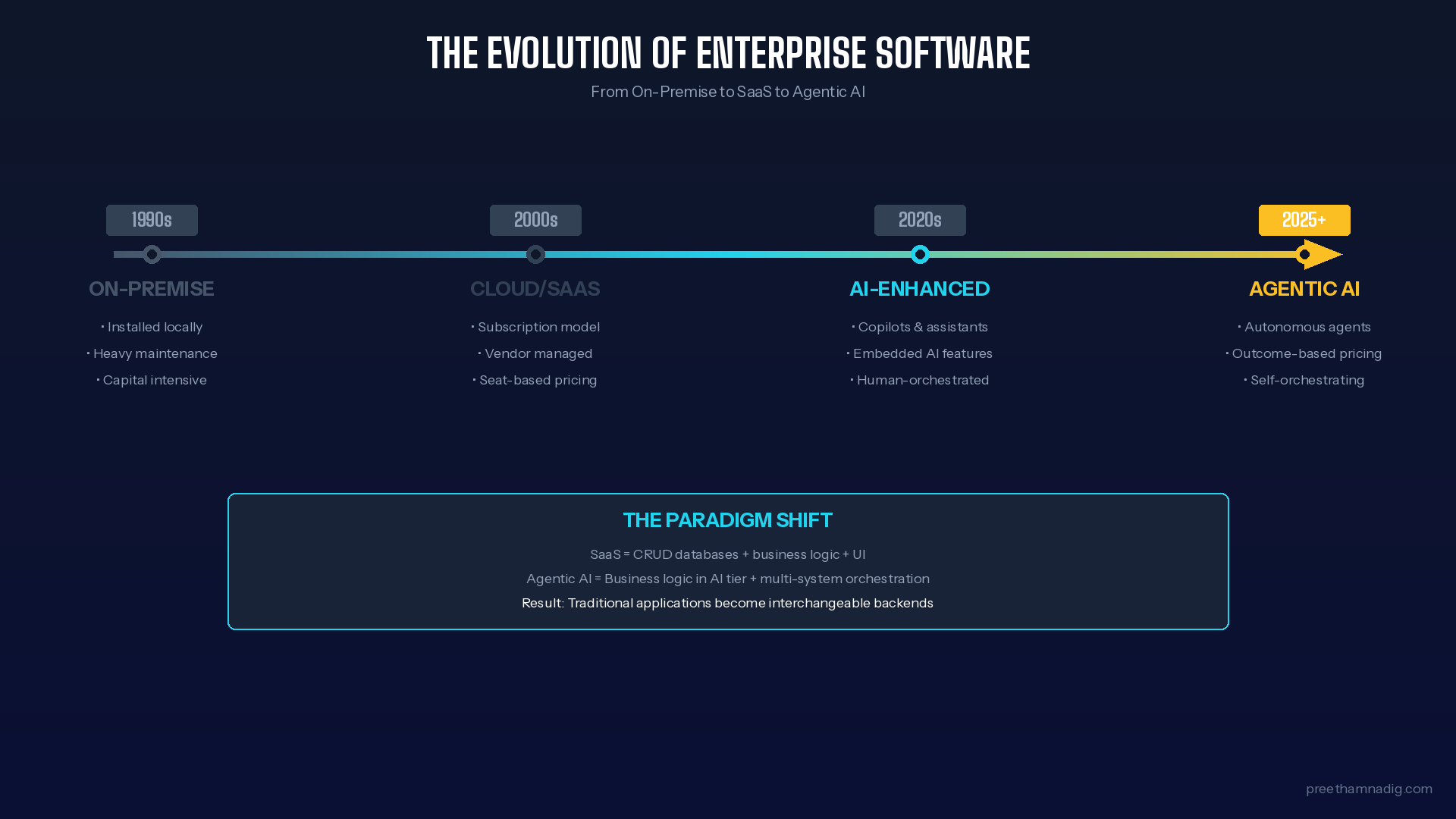

The Enterprise SaaS Debate: Five Themes Emerging from Industry Analysts and Tech Leaders

“The notion that business applications exist, that’s probably where they’ll all collapse, right? In the agent era.” — Satya Nadella, CEO of Microsoft, BG2 Podcast, December 2024 When Microsoft’s CEO makes a statement this provocative, it’s worth paying attention. Nadella’s comments on the BG2 podcast sparked significant debate across the… Read ⇢

-

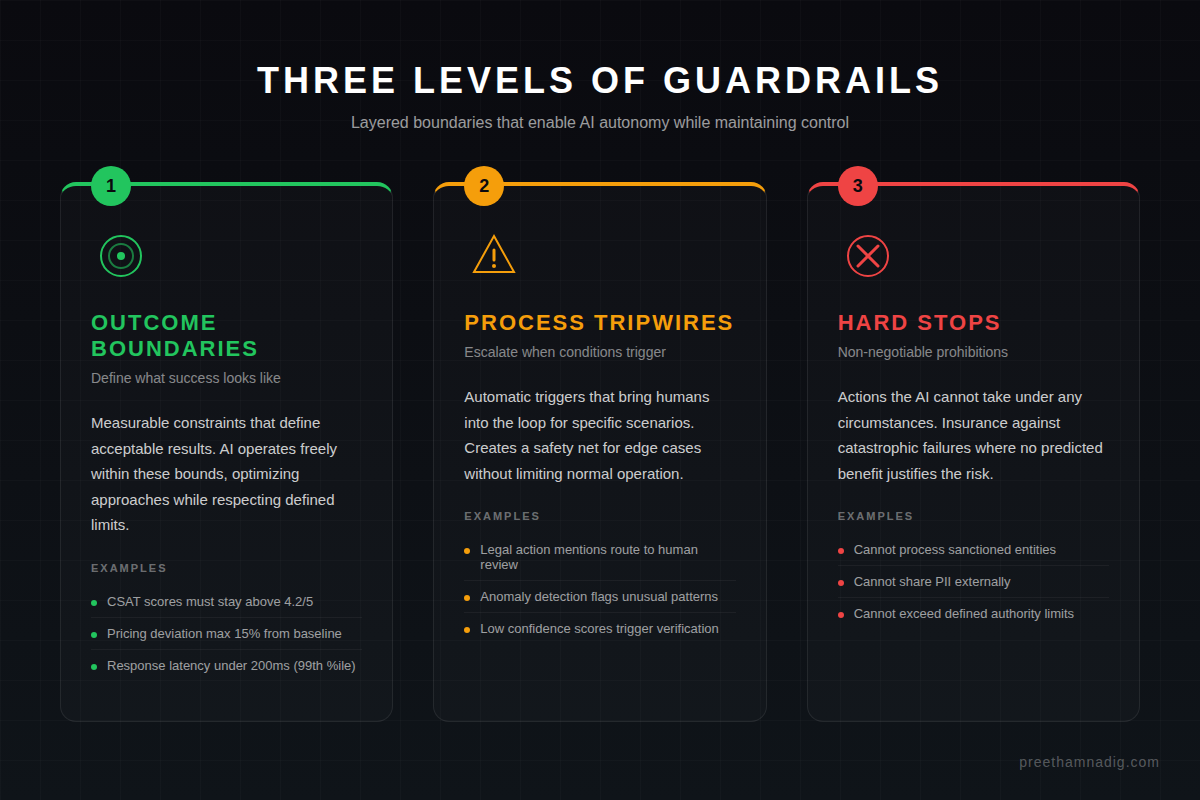

The Guardrails Imperative: Managing Outcomes When AI Takes the Wheel

When AI systems gain autonomy, your job shifts from controlling every step to defining the boundaries of acceptable outcomes. Here’s how to build the guardrails that let you sleep at night. In my previous post on AI scalability, I mentioned a fundamental shift that happens as organizations mature their AI… Read ⇢

-

From Quick Wins to Scalability: A Phased AI Adoption Roadmap

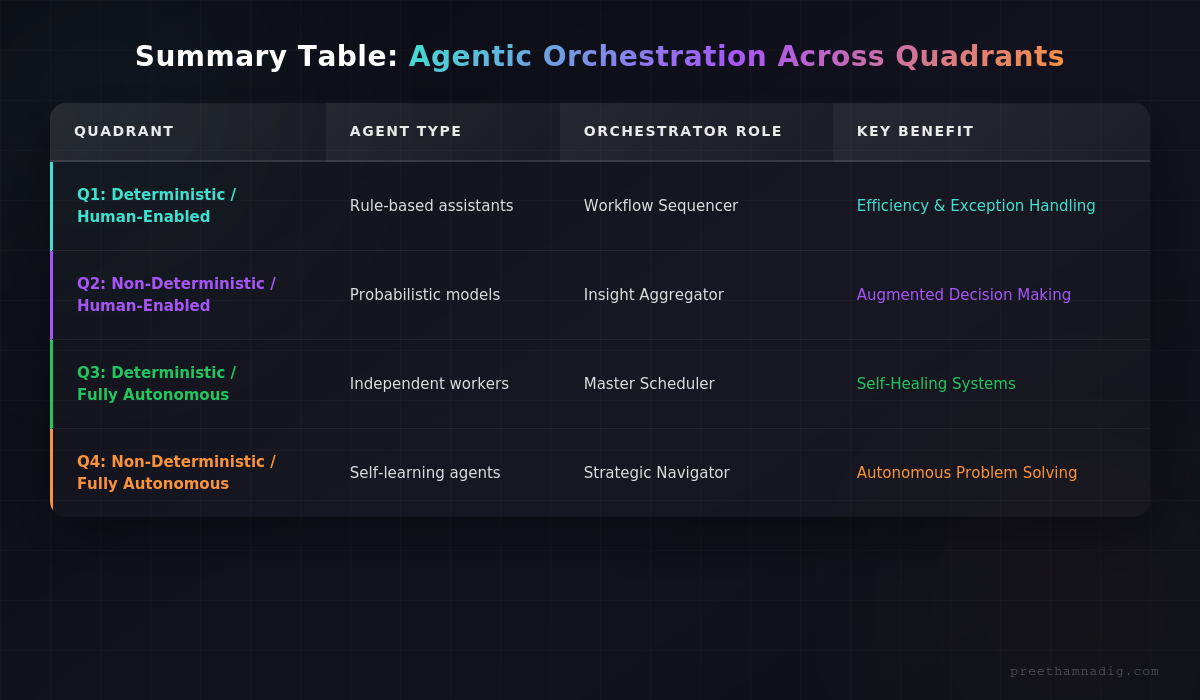

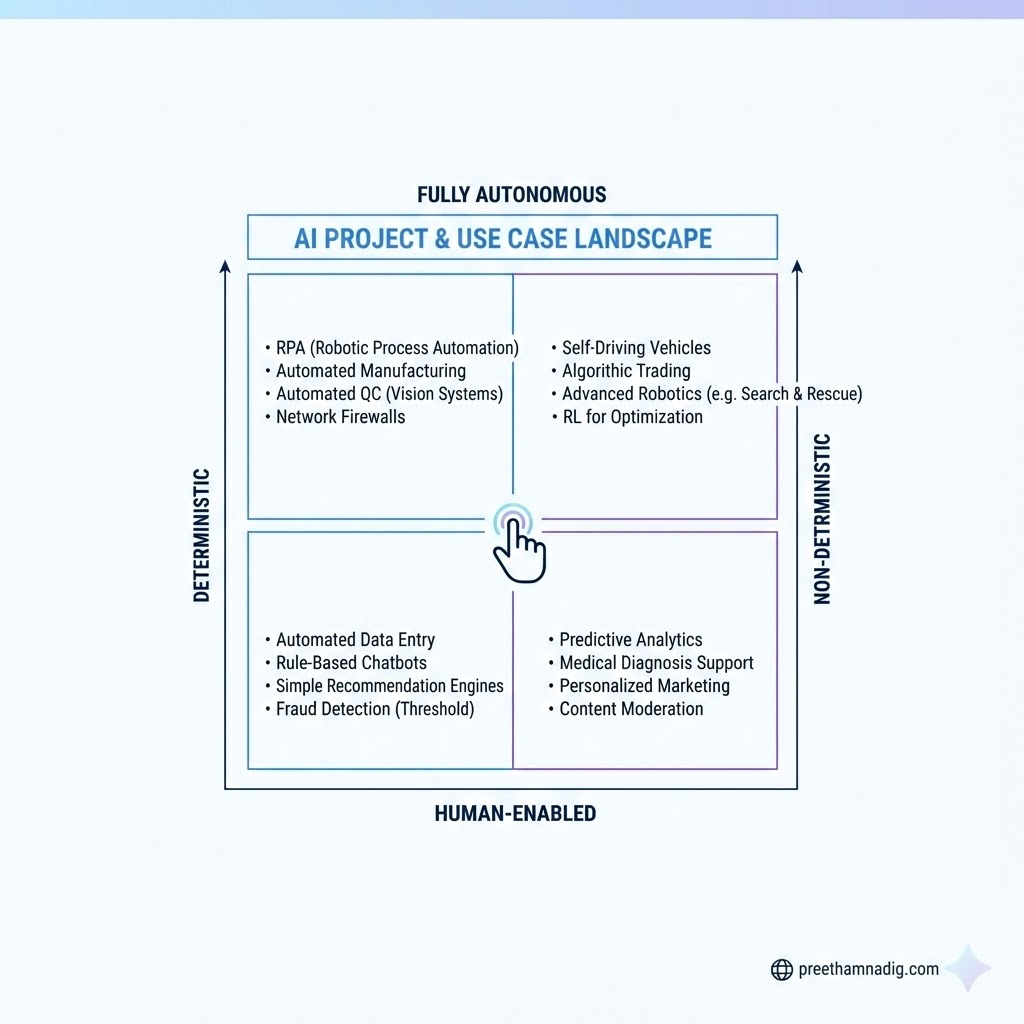

Building on my previous framework for navigating the AI landscape, this post offers a practical maturity model for organizations ready to progress from experimentation to enterprise-scale AI. In my previous post, I introduced a two-dimensional framework for evaluating AI projects: the intersection of Deterministic vs. Non-Deterministic systems and Human-Enabled vs.… Read ⇢

-

Orchestrating the Future: How Agentic AI Unifies Your Quadrant Strategy

In our previous post, we explored the crucial two-dimensional framework for AI projects: Deterministic vs. Non-Deterministic and Fully Autonomous vs. Human-Enabled. This matrix helps you strategically place and develop individual AI applications. But what happens when you need these diverse AI components to work together seamlessly, intelligently, and at scale?… Read ⇢

-

Navigating the AI Landscape: A Two-Dimensional Guide to Project Success

The world of Artificial Intelligence is vast and ever-expanding, offering incredible opportunities for innovation. But with so many possibilities, how do you choose the right AI project for your business or venture? The key lies in understanding the fundamental characteristics that define AI applications. In this post, we’ll explore AI… Read ⇢

-

Aam Aadmi’s Tips for staying on top of the Cloud!

In India, ‘Aam Aadmi’ (AD) means a common man. I am a big fan of relating strategy or business operations to things we do with a bit of common sense in the course of a normal day. India has a big demand for gold and historically households have had some… Read ⇢

-

How long before we ‘Samsunged’ instead of ‘Googled’??

As an ardent economics student I follow game theory in real life quite closely. It’s simple in essence but leaves me amazed with its innumerable applications for decision making in the real world. Today’s world of information convergence and consumerization of IT begs the Technology Companies to sharpen their game… Read ⇢

Digital Leadership Distilled.

Scaling Transformation Initiatives through Data, AI, and Human-Agent teaming. 20+ years of digital leadership distilled into weekly strategic deep dives. Don’t miss the next shift.